Click on each institution's name to see their respective Fellows.

Fall 2015 Fellows: Second Cohort

Bunmi Lawson, CEO, Accion Microfinance Bank Limited

Bunmi Lawson, CEO, Accion Microfinance Bank Limited

Ms. Lawson possesses a master's degree in Business Administration from the IESE Business School, University of Navarra. She is a Fellow of the Institute of Chartered Accountants of Nigeria and graduated in HND Accounting from the Yaba College of Technology. An Alumnus of the Lagos Business School, Mrs. Lawson has over 24 years working experience in various industries spanning SME business development, Finance, Marketing, Insurance, Consulting and Banking.

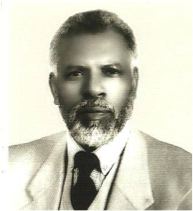

Segun Aina, Board Member, Accion Microfinance Bank Limited

Segun Aina, Board Member, Accion Microfinance Bank Limited

Mr. Aina began his banking career in 1974 with United Bank for Africa, and rose to be the Managing Director of the then Fountain Trust Bank Plc, now a part of Heritage Bank. He is the immediate past Chairman of the Council of the Chartered Institute of Bankers of Nigeria and former Chairman of Board of Trustees for the United Nations Development Program-Human Development Fund in Osun State. Mr. Aina obtained a BSc from the University of Lagos and MSc from the University of Ibadan. He is a Fellow of Chartered Institute of Bankers of London and Nigeria and recipient of the National Honor of the Order of the Federal Republic (OFR) among other awards.

Habiba Balogun, Board Member, Accion Microfinace Bank Limited

Habiba Balogun, Board Member, Accion Microfinace Bank Limited

Ms. Balogun is lead consultant at HBC with a specialization in Organization Effectiveness. She holds a Bachelor's Degree in French and Italian from the University of London and a Master's degree in Organizational Management from George Washington University. She is a certified Leadership Coach, Trainer and Neuro Linguistic Programming Practitioner. In her twenty-six year career, she has worked with clients in the US, UK, Netherlands, Cameroon, Gabon, Ghana, Senegal, South Africa, South Korea, Kenya and Nigeria including the Niger-Delta and has held various roles working in industries which include Banking, Manufacturing, Import-Export, Marketing, Media, Education and Oil & Gas.

Reki Moussa Hassane, CEO, ASUSU SA, Niger

Reki Moussa Hassane, CEO, ASUSU SA, Niger

Ms. Hassane is the Director General of Asusu SA, and President and CEO of Holding ASUSU. Prior to her role with ASUSU, Ms. Hassane worked with CARE International as the head of the Women's Resource Mobilization Project, Coordinator of Microfinance program and Gender Commission. She then actively participated in the development of both the Mata Masu Dubara methodology (MMD) and "Agent Villagers,' a mentoring system of farmers' organizations, established in 1997. Ms. Hassane has a degree in applied economics and experience in the microfinance field.

Hamma Hamadou, Board Member, ASUSU, SA, Niger

Hamma Hamadou, Board Member, ASUSU, SA, Niger

Mr. Hamadou is the Managing Director of GLOBAL SAHEL SA, a shareholder of ASUSU SA. He has twice served as the Director General of Tax Administration from 2004 to 2010 and 2013 to 2015. Previously, Mr. Hamadou worked as the Director General of SOPAMIN SA, Finance and Economic Advisor in the Niger Embassy of Brussels, Senior Finance and Tax Advisor to the President of the Republic of Niger, and the Senior Advisor to the Minister at the Ministry of Mines. He holds degrees from the Ecole Nationale d'Aministration in France and the Ecole Nationale d'Administration in Niger.

Henri Blaise Tiam, Board Member, ASUSU, SA, Niger

Henri Blaise Tiam, Board Member, ASUSU, SA, Niger

Mr Henri Blaise TIAM has been involved in private equity industry for the last 15 years. Prior to its current occupation, Mr Tiam has been Head of Investment Department at CENAINVEST a Central Africa based private equity firm. In 2007 he joined AFRICAP a leading microfinance private equity fund based in Johannesburg in South Africa. He managed to develop a significant portfolio of MFIs in the French speaking countries in Central and West Africa. After the Africap venture, Mr Tiam joined a Swedish investment company called NORDIC MICROCAP INVESTMENT where he operated as the Africa Manager dedicated to West and Central Africa. In parallel to its duties, Mr TIAM as served as a board member of several companies in Africa. Mr TIAM is a holder of a Master degree in Management and a fellow member of an Executive MBA from the Harvard Business School.

Dr. Simon Kagugube, Executive Director, Centenary Bank in Uganda

Dr. Simon Kagugube, Executive Director, Centenary Bank in Uganda

Mr. Kagugube has served in a variety of board positions with Centenary Bank, Monitor Publications Limited, and Nation Media Group. Previously, Mr. Kagugube worked as the Finance Director with NICE House of Plastics, Deputy Commissioner-General and Commissioner of Value Added Tax of the Uganda Revenue Authority, and Director of Tax and Legal Services with PricewaterhouseCoopers. He has a LLB from Makerere University, an LLM and Doctorate in the Science of Law from Yale Law School: and a Certificate in Public Finance from University of Bath.

Exekiel Phiri, CEO, CUMO

Exekiel Phiri, CEO, CUMO

Ezekiel Phiri is a microfinance and development finance expert with 30 years of experience gained in three countries in Africa (Malawi, Swaziland and Cape Verde Islands) with core expertise in agricultural and enterprise development, value chains development, project design, appraisal, implementation and management. He has proven ability in setting up and managing financial institutions that target small and medium scale enterprises (SMEs) and in setting up and implementing internal controls, accounting and financial management systems as well as in designing and implementing privatization programs for support services in large manufacturing operations to become operated by SMEs. He is an experienced financial consultant and mentor with high analytical and budgeting skills and knowledge working on projects financed by European Union, UNDP/UNCDF, USAID, KFW, GTZ, DfID, the Netherlands International Co-operation Branch (DGIS), Tear Fund, Geneva Global, and Norwegian Church Aid and HIVOS. Ezekiel Phiri holds a Masters Degree in Banking and finance obtained in 1987 Italy and a Bachelor's Degree in Accountancy obtained from the Malawi Polytechnic in 1983.

Heather Campbell, Board Chair, CUMO

Heather Campbell, Board Chair, CUMO

Heather Campbell Heather is a native of Salt Lake City, Utah with over 16 years of international experience managing development and humanitarian programming worldwide. She studied international relations at the Johns Hopkins University followed by her first international work as a Woodrow Wilson Research Fellow, exploring the negative externalities of China's One Child Policy while working in Chinese Orphanages. After 3 years in China, she did a Masters in Humanitarian Assistance at Uppsala University in Sweden and in the subsequent decade has held a variety roles with donors and NGOs in countries including Kenya, Pakistan, Afghanistan, Tajikistan, West Bank, USA, East Timor and Malawi. She worked as a Country Director in Pakistan, East Timor and now Malawi for Concern Universal. Heather has worked with Microfinance institutions in Afghanistan and Pakistan and currently is the Chairman of the Board for CUMO Microfinance in Malawi.

Dye Mawindo, Board Member, CUMO

Dye Mawindo, Board Member, CUMO

Dye Mawindo is a general management expert. Having started his career in the legal profession, Dye Mawindo moved on to the public sector when he joined the Malawi Development Corporation and rose to the position of General Manager (Designate). He left MDC after eight years to take up the position of Comptroller of Statutory Corporations in which position he was responsible for overseeing the performance of the whole parastatal sector in Malawi. After this position, he was appointed the first Executive Director of the Privatisation Commission when it was set up in 1996. He remained in this position for a period of six years before leaving to join the Office of the Vice President of Malawi as a Governance Adviser under a DfID funded programme. On the expiry of his contract, he was approached to manage (as Chief of Party) a Governance Project funded by the USAID/Millennium Challenge Corporation supporting the Malawi National Assembly until March 31s, 2008. He is currently Malawi's Director of Public Procurement.

Henry Mvaya, Board Member, CUMO

Henry Mvaya, Board Member, CUMO

Mr. Mvaya is the Finance & Administration Manager for the Malawi Program. After working with the Agricultural Development and Marketing Corporation (ADMARC) as an Accountant for four years, he joined Electricity Supply Commission of Malawi (ESCOM), the only company responsible for generation and distribution of electricity in Malawi, in 1982. He worked in different capacities rising to the position of Financial Controller in 1992. He participated in the restructuring process of the organization leading to the separation of the postal and telecommunications businesses and the creation of Malawi Telecommunications Ltd (MTL) and Malawi Posts Corporation (MPC) in June 2000. Mr. Mvaya remained with MTL as Director of Finance but later moved to MPC at the same position until 2001. He joined Concern Universal in 2002 as Finance Manager and later Finance & Administration Manager after the restructuring of the Malawi Program. Henry holds an MSc (Accounting & Finance) from the University of Stirling, Scotland and a Diploma (Business Studies) from Polytechnic, University of Malawi.

Jennifer Mugalu, CEO, ECLOF

Jennifer Mugalu, CEO, ECLOF

Ms. Mugalu, is an accountant by training with an Executive Master Degree in Business Administration and over 15 years executive experience in strategic management, financial management, Corporate Governance, change management, Human Resource management, leadership and team building, microfinance and organization development for both NGO and Private Companies.

Vincent Freedom Kaheeru, Board Chair, ECLOF

Mr. Kaheeru, is the Managing Director, VFK & Associates Consulting Limited and National Director, Profiles International Uganda Ltd. These two private firms provide Management Consultancy services with a focus on Human Resource Management Solutions and Corporate Governance. He previously sat on the Steering Committee on the East African corporate governance promotional bodies and as the CEO of the Institute of Corporate Governance of Uganda until December 2007. Mr. Kaheeru serves as the Chairman Board of Directors for ECLOF Uganda, ECLOF International and Crystal Clear Software Limited and has recently been appointed to the Board of Agribusiness Initiative Trust (aBi Trust) a multi-donor entity jointly founded by the Governments of Denmark and Uganda.

Kunle Oketikun, CEO of Fortis Microfinance Bank in Nigeria

Kunle Oketikun, CEO of Fortis Microfinance Bank in Nigeria

Mr. Oketikun is the CEO of Fortis with over 22 years of experience in Banking. He has competencies acquired in senior positions within Retail, Corporate, and Investment Banking from Standard Trust Bank (Now UBA), Lead bank Plc., and Ecobank Nigeria Plc. Prior to Fortis, he was responsible for Ecobank's branches in Abuja and the Northern states. He was the pioneer Executive Director, Operations and Risk Management in Fortis Microfinance Bank, before being appointed Managing Director/CEO. He is an Associate member of various professional associations including the Chartered Institute of Bankers of Nigeria (HCIB), Institute of Cost Management (ICM), and Nigerian Institute of Management (ACIM). Mr. Oketikun is an Alumnus of University of Ibadan, Delta State University, Boulder Institute of Microfinance Italy, and Harvard Business School in the USA. He is also an honorary senior member of Chartered Institute of Bankers of Nigeria, Institute of Cost Management, Risk Management Association of Nigeria, and Chartered Institute of Management.

Birame Kane, CEO, Première Agence de MicroFinance (PAMF)

Mr. Kana possesses more than twenty five years of experience in the microfinance industry. He has specialized in the areas of crisis management, start-up organization, market research, training, gender empowerment, and Adult Literacy project management. Prior to Mr. Kana's microfinance career, he worked in the Fishery, Forestry and Economic Development sector and as a university Professor. He has an MBA from the HEC of Montreal.

Mamoud Rajan, Board Chair, PAMF

Mamoud Rajan, Board Chair, PAMF

Since 2011, Mahmoud Rajan has served as the Chairman of the Board of Directors for First MicroFinance West Africa and at its affiliates in Côte d'Ivoire, Burkina Faso and Mali. Previously, Mr. Rajan worked in West Africa for IPS (WA) a subsidiary of the Aga Khan Fund for Economic Development ( AKFED) and as the CEO between 2005 and 2013. Mr. Rajan is a graduate of the Solvay Business School of Economics and Management, Université Libre de Bruxelles,and has followed the HEC Management Program for Leaders and the Boulder Microfinance Training Program.

Benoit Destouchest, Board Member, PAMF

Benoit Destouchest, Board Member, PAMF

Mr. Destouches joined the Aga Khan Agency for Microfinance (AKAM) in 2007 as the Finance Director. AKAM is a network of 10 institutions in South and Central Asia, the Middle East and Sub-Saharan Africa. Previously, Mr. Destouches spent four years in Central Asia (including Afghanistan, Tajikistan and the Kyrgyz Republic) as Chief Financial Officer of a French NGO, ACTED. He also spent two years as Finance Director of ACTED in its headquarters in Paris, overseeing the operations in more than 20 countries. Mr. Destouches is a graduate of ESSEC (2000), a French Business School and holds a Master's Degree in International Relations from IEP Paris (2002).

Lilian Mbassy, Acting MD, Opportunity Tanzania

Lilian Mbassy, Acting MD, Opportunity Tanzania

Ms. Mbassy has over 10 years of commercial banking and Microfinance Operations experience. She currently serves as the Chief Operations Officer and Acting CEO of Opportunity Tanzania Limited (OTL). Prior to this role, Ms. Mbassy worked as the Head of Internal Audit for OTL and as the Senior Internal Auditor for National Microfinance Bank (NMB) Bank Ltd. Ms. Mbassy has a Master's of Business Administration from Mzumbe University and a Bachelor of Business Administration (B.B.A.), Business Administration and Management, General from the University of Botswana.

Diana Monica Kisaka, Board Member, Opportunity Tanzania

Diana Monica Kisaka, Board Member, Opportunity Tanzania

Ms. Kisaka is Managing Director of T-MARC Tanzania, where she successfully built T-MARC into a sustainable organization by providing it with technical and administrative leadership. By assuming overall accountability for the achievement of the NGO's mission and strategies in compliance with Government of Tanzania and donor requirements, she has managed to raise its profile highly among partners and stakeholders. She doubles as secretary to the board of T-MARC and sits on the Boards of the First National Bank Tanzania, Opportunity Tanzania, GO Finance, Strategies Health Insurance and is outgoing Director for the Legal and Human Right Centre Tanzania (LHRCT). Prior to joining T-MARC, Ms. Kisaka held senior positions in the banking industry, including Head of Channels of distribution, responsibilities in which she has worked diligently to improve efficiency, service quality, manpower and profitability. Ms. Kisaka holds a Masters of Business Administration (MBA Honors) Bangalore University, India

Tezera Kebede Bekele, CEO, Peace MFI

Tezera Kebede Bekele, CEO, Peace MFI

Since 2000, Mr. Bekele has served as the CEO and founding shareholder of PEACE MFI. Prior to joining PEACE, Mr. Bekele worked as a Branch Manager of Wisdom MFI and worked in the Ministry of Trade & Industry largely in areas of handicrafts, small scale industry and micro enterprise development. Mr. Tezera has MBA in financial management, a Diploma in management, a post graduate diploma in management, and a postgraduate diploma in financial management, from Indira Gandhi National Open University. In addition he has a Bachelor of Arts Degree in Economics from Addis Ababa University and an Associates Bachelor's Degree in Microfinance and community economic development from Uganda Martyrs University. Mr. Tezera has also undertaken a number of short-term courses and is a certified trainer of the CGAP course "Skills for Microfinance Managers." He is also accredited and certified for MFTOT blended distance course and was country tutor for MFTOT9 and MFTOT10.

Mammo Kebbede Shenkuyt, Board Member, Peace MFI

Mammo Kebbede Shenkuyt, Board Member, Peace MFI

Mr. Mammo is one of the founding shareholders of PEACE MFI. He previously served as the Board Chairman of Agri Service Ethiopia. He has extensive experiences in the areas of education, radio broadcasting and adult education. He served as managing director of the Adult & None Formal Education (NFE) Association in Ethiopia. Mr. Mammo has B.A in English in Ethiopian Language and Literature, from Hailesilsie I University and a certificate of Communication Planning and Strategy from Cornell University. Mr. Mammo was a key player in Ethiopia's National Literacy Campaign and adult education and has received national and international recognition for his contributions.

Anthony Gyasi-Fosu, CEO, Sinapi Aba

Mr. Gyasi-Fosu has served as the CEO of SASL for the last 10 years. He led the successful transformation of Sinapi Aba Trust (SAT), a financial NGO to a regulated Banking Institution, SASL. Mr. Gyasi-Fosu has over 15 years working experience in the banking and microfinance industry. He holds an MBA and a Post Graduate Diploma in Business Administration from Ghana's leading Business School; Ghana Institute of Management and Public Administration (GIMPA). He also holds a Bachelor of Science degree in Agricultural Economics from the Kwame Nkrumah University of Science and Technology, Kumasi, Ghana. Until recently, he served on the Amanten & Kasei Community Bank (AKCB) Board, chairing its Finance and Audit Committee.

Joseph Hewton, Board Chair, Sinapi Aba

Joseph Hewton, Board Chair, Sinapi Aba

Mr. Hewton is the Managing Director of Johaze Limited, a Road Construction Company based in Accra and operating in the Central and the Ashanti Regions of Ghana. He is the Chairman of the Board of SASL. He also serves as the Vice Chair of the Sinapi Aba Trust Board, the Chairman of the Ghana National Association of Road Contractors and a member of the Ghana National Roads Fund Board. Mr. Hewton is a graduate of the University of Ghana and has attended lots of conferences and courses in leadership and entrepreneurship.

Ngor Kacgor, Board Member, SSMDF

Mr. Kacgor is currently the CEO and Managing Director of Regional Trade & Contracting and Petrotech Co. LTD respectively. Furthermore, he is a member and/or a chairperson of a number of business firms' board of directors. He is also a board member of South Sudan Economic Association (SSEA) and South Sudan Microfinance Development Facility (SSMDF). Mr. Kacgor is the Former Chairman of South Sudan's Chamber of Commerce, Industry and Agriculture. He contributed in the establishment of many business and banking entities in both Sudan and South Sudan. In 2004 – 2005, as part of the preparation for the peace agreement in the Sudan he was appointed the chairman of the private sector sub-cluster in the Joint Assessment Mission (JAM), which was an assessment study conducted under the support of the United Nation (UN) and the World Bank (WB) to identify the post war urgent needs of Sudan in general and South Sudan in particular in all sectors. In 2005 – 2009, he led the process of the establishment of the first South Sudan Chamber of Commerce, Industry & Agriculture (SSCIA) and became the first chairman thereof, and in the same period was a board member of South Sudan Investment Authority. Mr. Kacgor Mathiang holds Bachelors of Science, BSc (Hon) in Business Administration from the University of Juba (2004).

Albino Dak Othow, Board Member, SSDMF

Albino Dak Othow, Board Member, SSDMF

Mr. Othow has 25 years of banking experiences in all areas of banking aspect. Mr. Othow is the Director General of Bank Supervision for the Bank of South Sudan. He is also on the board of Ivory Bank. He has worked in various departments of the Central Bank of Sudan Headquarters in Khartoum including the foreign exchange department, accounts department and banking supervision department. He holds a Master's in Business Administration from the University of Juba, a Post Graduate Diploma in Public Administration from the University of Khartoum and a BSc in Commerce and Business administration from Cairo University of Khartoum Branch1.

Mr. Tsikirayi has 38 years in Banking of which 16 years was as Managing Director and CEO roles. He is currently the Regional Director for Urwego and other African countries for Opportunity International. Previously Mr. Tsikirayi worked with BCR in Rwanda and Standard Chartered Bank both in Tanzania, Sierra Leone and The Gambia. In addition to serving on the board of Urwego Opportunity Bank, Mr. Tsikirayi is a Non-Executive Director of Opportunity International DRC and Standard Chartered Bank Tanzania Limited.

Stanley Tsikirayi, Board Member, Urwego Opportunity Bank

Stanley Tsikirayi, Board Member, Urwego Opportunity Bank

Adet Kachi, CEO, Yehu Microfinance Trust

In 2006, Mr. Kachi became CEO of Yehu Microfinance Trust. He has served in the microfinance industry for over 10 years in top management in Kenya and Southern Africa with qualifications in strategic management and related discipline. Mr. Kachi has a Continuing Doctorate of Philosophy, (Business Administration), Masters in Business Administration (MBA). He also serves in the Board of Association of Microfinance Institutions of Kenya (AMFI).

2015 Fellows: First Cohort

Israel Chasosa, CEO of Akiba Commercial Bank in Tanzania

Mr. Chasosa, a Zimbabwe national, has worked in the banking industry for over 30 years in different countries. He started his career in 1976 with Standard Chartered Bank for two years where he worked in various departments. He then went for studies in banking and finance in the UK for four years. Upon his return in 1982, he joined Zimbabwe Banking Corporation as a management trainee and rose up the ranks. In 1990 he was seconded to the bank’s subsidiary in Botswana which was subsequently sold to First National Bank of Botswana where he was seconded for three years until 1997. He returned to Zimbabwe and joined African Banking Corporation Limited and worked in various capacities until his appointed in 2003 as MD for their Malawi operations. In 2005 he was appointed MD for African Banking Corporation Tanzania Limited until 2011 when he resigned to form and run Amana Bank Limited, the first fully fledged Islamic bank in Tanzania. At the end of his contract in 2014, he left that bank and was involved in some private consultancy prior to joining Akiba Commercial Bank Limited in April 2015. Israel is an alumnus of John Moore University, Liverpool, UK and University of KwaZulu-Natal, South Africa and is an avid golfer.

Brian Kuwik, Board Member of Akiba Commercial Bank in Tanzania

Brian Kuwik, Board Member of Akiba Commercial Bank in Tanzania

Mr. Kuwik sits on the board of Akiba Commercial Bank in Tanzania and plays an active role in governance, and provides strategic and financial advice. He also supervises Accion's technical assistance activities in the areas of strategic and business planning, product and operations development, human resources management, information technology, and risk management from its office in Ghana. Previously, he served as resident advisor and senior manager for Accion partners in Zimbabwe, Uganda, and Haiti. He has supported the design and start-up of new institutions in Nigeria, Ghana, and Cameroon.

Joseph Rugumyamheto, Board Member of Akiba Commercial Bank in Tanzania

Joseph Rugumyamheto, Board Member of Akiba Commercial Bank in Tanzania

Mr. Rugumyamheto sits on the board of a number of national and multi-national organizations in addition to Akiba Commercial Bank, and has served as both a board member and chair. He has had a career in public service for 35 years, ten of which were with the Permanent Secretary of Tanzania overseeing public service reforms. He has also served as a consultant to international organizations, both within Tanzania and throughout Africa. Mr. Rugumyamheto has been active in academia, teaching in a number of institutions of higher learning and training. Since his retirement in 2006, Mr. Rugumyamheto has been engaged in extensive sharing of knowledge and experiences at various consultancies and organizations. He has expertise in leadership in strategic change, people development, and capacity building, and has written and presented papers on reforming public services in Tanzania. Mr. Rugumyamheto holds a BA from the University of Dar es Salaam in Tanzania, an MA from Stanford University in California, US.

Marie Louise Nsabiyumva, CEO of CECM Microfinance in Burundi, Vice Chair of the Burundian Microfiance Network

Marie Louise Nsabiyumva, CEO of CECM Microfinance in Burundi, Vice Chair of the Burundian Microfiance Network

Marie Louise Nsabiyumva is the Director General of Caisse Coopérative d’Epargne et de Crédit Mutuel in Burundi and her institution is serving 74% women clients. In the words of a Women’s World Banking staff member whom she works with: “Their General Manager, Marie Louise, is a true leader, and the entire institution has a commitment to women (both as clients and on staff).

Judith Sakubu, Board Member of CECM Microfinance in Burundi

Judith Sakubu, Board Member of CECM Microfinance in Burundi

Ms. Sakubu was a Humphrey Fellow in the 2013-2014 class at Pennsylvania State University. Her field of study was Educational Administration Planning and Policy. She holds a BA in English Language and Literature. She has a total of 28 years of teaching experience. She is the Chair of the Board of Directors at Ecole Technique d’Admnistration et de Gestion in Bujumbura. She coordinated the International Language Center of Bujumbura from 2005 to 2010, and now coordinates the Burundi English Teachers’ Forum. Ms. Sakubu initiated a new association called APECEPE whose objective is to implement community technical secondary schools in the countryside. She is a member of the Board of Directors in SCOM-Terimbere, and a member of the Board of Directors of CECM microfinance.

Fabian Kasi, CEO of Centenary Bank in Uganda

Fabian Kasi, CEO of Centenary Bank in Uganda

Mr. Kasi is the CEO of Centenary Bank. He holds an MBA from the University of Newcastle in Australia. He also holds a first class degree of bachelor of commerce in accounting. He is currently the Managing Director of Centenary Bank, Uganda. Prior to this, he worked for the Central Bank (Bank of Uganda) in the Banks Supervision Function for eight years, and then as Finance and Administration Manager for FINCA Uganda Ltd, before he started working as a Chief Finance Officer for Banque Commerciale du Rwanda for one year. In 2002, he was appointed as Chief Executive Officer of FINCA Uganda Ltd MDI, the very first licensed microfinance deposit taking institution in Uganda, until mid-2010 when he started working with Centenary Bank.

John Ddumba Ssentamu, Board Chair of Centenary Bank in Uganda

John Ddumba Ssentamu, Board Chair of Centenary Bank in Uganda

Mr. Ddumba Ssentamu is the chairman of the board at Centenary Bank. He is an economist, academic and a banker. Currently he is a Professor of Economics and the Vice-Chancellor at Makerere University, Uganda's oldest university, founded in 1922. At the time of his appointment to his current post, he was the Principal of the College of Business and Management Science at Makerere University. He is reported to have about 30 publications to his name. He holds an MBA in Economics from the University of Waterloo in Canada, and a PhD, also in Economics, from Makerere University. He has served as Chairman for over 10 years, during which period, the bank has grown from a small microfinance institution into the second-largest indigenous commercial bank in Uganda.

Charles K. Njuguna, MD of Faulu Microfinance Bank in Kenya

Charles K. Njuguna, MD of Faulu Microfinance Bank in Kenya

Mr. Njuguna was appointed Managing Director of Faulu Microfinance Bank in August 2014. He previously worked as the Chief Finance Officer, Old Mutual Kenya, for 5 years where alongside overseeing the Finance Department he handled various strategic roles within the organisation. He commenced his career with ABN Amro Bank before moving to Fina Bank as the Group Head of Finance with a regional responsibility and was closely involved in the acquisitions and setting up operations within the region. He has over 20 years of experience in the Banking Industry/Financial Services. Charles is a holder of an MBA and an AMP from IESE Business School, Spain. He is also a Certified Public Accountant as well as a Certified Public Secretary. He serves on various Old Mutual Kenya boards as an Executive Director.

George Maina, Board Member of Faulu Microfinance Bank in Kenya

George Maina, Board Member of Faulu Microfinance Bank in Kenya

Mr. Maina has served in Faulu Microfinance Bank Board since 2003. He has worked for the Shell Group of Companies at MD/CEO and other senior management positions in East Africa, West Africa, the Caribbean and Central America and at the Africa Management team. He is currently a business consultant and businessman. He holds a Bachelor of Technology from the Loughborough University in the UK. George currently sits in the boards of a number of listed and private companies in Manufacturing, Agro-Processing, Trading and Financial Services. He is also a trustee of a pension fund, an education institution, a hospital and a conservation organization.

Edward Lamptey, COO of First Allied Savings & Loans in Ghana

Edward Lamptey, COO of First Allied Savings & Loans in Ghana

Mr. Lamptey is the Chief Operating Officer of First Allied Savings & Loan Ltd, a leading, reputable and pacesetting financial institution in Ghana. Mr. Lamptey assumed this position with a vast career experience from diverse business engagements at senior management level, both nationally and internationally, including with the Bank of Ghana, Barclays Bank Ghana, JFK Accountancy Services – London, and Eagle House Group Ltd – London, among others. Mr. Lamptey is a Chartered Accountant and holds an MBA from the University of Leicester.

Michael Quarshie, Vice Chairman, Board Member of First Allied Savings & Loans in Ghana

Michael Quarshie, Vice Chairman, Board Member of First Allied Savings & Loans in Ghana

Mr. Quarshie, co-founded Persol Systems Limited, a leading software developer, systems integrator and IT consulting firm in Ghana in 1995. Michael has an MBA from INSEAD in France and worked briefly as an Associate in the City of London for the German investment bank, WestLB Panmure. He is a member of the Board of First Allied Savings & Loans Company. Michael has a honors first degree in Biochemistry from KNUST, Ghana, and is the Managing Director of Persol.

Emmanuel Asiedu-Appiah, Board Member of First Allied Savings & Loans in Ghana

Emmanuel Asiedu-Appiah, Board Member of First Allied Savings & Loans in Ghana

Mr. Asiedu-Appiah holds a combined first degree in Accounting and Economics from the University of Ghana Business School. He also holds an MBA with specialization in Finance and International Business from the Graduate School of International Studies, Yonsei University, Seoul, Korea. He is a member of the Chartered Institute of Marketing Ghana. Emmanuel has had over 20 years working experience in banking and finance, having worked with Barclays Bank of Ghana Ltd, Bank for Housing and Construction and the Trust Bank, all in Ghana, and the Korea Long Term Credit Bank in Seoul. He also worked as the General Manager of Dapeg Ltd, a Marketing and Advertising Company in Ghana, while in this position he doubled up as the Marketing Development Provider for Microsoft Corporation in Ghana. He was also for 5 years the General Manager of the Ghana Export Finance Company Ltd. In 2005 he served as consultant to the Ministry of Trade and Industries in Ghana towards the establishment of the Ghana Export Trade Company. Until his retirement from formal work in 2014, Emmanuel was the Director of Finance at the Lincoln Community School in Accra where he worked for 7 years. Emmanuel is an ordained minister of the Gospel and now works as the Pastor of Redeemed Baptist Church at Oyarifa in Accra. He is married to Elsie with two adult children.

Kunle Oketikun, CEO of Fortis Microfinance Bank in Nigeria

Kunle Oketikun, CEO of Fortis Microfinance Bank in Nigeria

Mr. Oketikun is the CEO of Fortis with over 22 years of experience in Banking. He has competencies acquired in senior positions within Retail, Corporate, and Investment Banking from Standard Trust Bank (Now UBA), Lead bank Plc., and Ecobank Nigeria Plc. Prior to Fortis, he was responsible for Ecobank's branches in Abuja and the Northern states. He was the pioneer Executive Director, Operations and Risk Management in Fortis Microfinance Bank, before being appointed Managing Director/CEO. He is an Associate member of various professional associations including the Chartered Institute of Bankers of Nigeria (HCIB), Institute of Cost Management (ICM), and Nigerian Institute of Management (ACIM). Mr. Oketikun is an Alumnus of University of Ibadan, Delta State University, Boulder Institute of Microfinance Italy, and Harvard Business School in the USA. He is also an honorary senior member of Chartered Institute of Bankers of Nigeria, Institute of Cost Management, Risk Management Association of Nigeria, and Chartered Institute of Management.

Felix Achibiri, Board Chair of Fortis Microfinance Bank in Nigeria

Felix Achibiri, Board Chair of Fortis Microfinance Bank in Nigeria

Mr. Achibiri is the Executive Chairman/Founder of DFC Holdings Limited, a privately owned, internationally diversified African company set up to seize the increasing investment opportunities in Nigeria and the African Continent. His entrepreneurial experience spans over 20 years and his core skills include Leadership, Business Conceptualization, Development and Strategy. Mr. Achibiri sits on the board of several companies. He is the Executive Vice Chairman and CEO of Rural Steel Bridging Limited, Executive Chairman Site Services Technologies Limited, Director Petroleum Projects International (PPI), Director Gelmark Power Solutions Limited, Vice Chairman Greenfields Global Inceptis, the owners and managers of the planned Osolu Island Pam Resort. Mr. Achibiri is also a Director of Genesis Energy Group Limited, the parent company of Genesis Electricity Limited. The company has just completed the development of the flagship multi-million dollar 84MW Distributed Power Project (DPP), in partnership with General Electricity of USA (GE), at the back of a 20 year Power Purchase Agreement with the Nigerian National Petroleum Corporation (NNPC) for a dedicated electricity power supply to the largest refinery complex in Sub Sahara Africa, NNPC’s Port Harcourt Refinery Facility. Mr. Achibiri has been conferred with several awards locally and across the globe. He is a member of the prestigious Conservative African Business Group London, a member of the British Safety Council, a member of the African Energy Association, a Fellow of the Institute of Professional Industrialists and Management Development (IPIMD), and a Fellow of the Institute of Credit Administration (ICA), a recipient of the Institute of Credit Administration (ICA) Credit Management Honors Award 2014 and Chairman’s Merit Award from the Chairman, Nigerian Society of Engineers, Water Division, for his contribution to Engineering, just to mention a few. He and his team at DFC Holdings Limited were recently recognized for quality, innovation and excellence by the Business Initiative Directions (BID) and was conferred with the Century International Quality ERA award, Gold Category (2015). He is widely travelled and has attended several international professional courses, exhibitions and workshops. Mr. Achibiri brings on board his unwavering strength in identifying opportunities, making the right connection and building relationships for actualization of set business goals.

Ebrima Ganno, CEO of Gambia Women’s Finance Association (GAWFA) in The Gambia

Mr. Ganno has been the CEO of GAWFA since 2013. He also served as GAWFA’s Operations Manager (2012-2013) and Branch Manager (2009-2012). He holds a Diploma in Small and Medium Enterprise Development from the Management Development Institute in The Gambia, Certificates in Integrated Rural Development from The Gambian Rural Development Institute (RDI), as well as Micro Finance Operations and Management from the Ghana Institute of Management and Public Adminstration (GIMPA) and series of in house capacity building with Women’s World Banking.

Fatoumata Tambajang, Board Chair of Gambia Women’s Finance Association (GAWFA)

Fatoumata Tambajang, Board Chair of Gambia Women’s Finance Association (GAWFA)

Ms. Tambajang is the Chairperson of GAWFA's Loans and Fund Raising Committees and the Vice Chairperson of the Finance Committee. She is the Coordinator and one of three resource persons for the establishment of GAWFA (1986-1987), the team leader of the National Women's Council of lobbyists for GAWFA's US$1 million Capital Grant from the First World Bank, and one of 11 founder members/fund raisers for the Women's World Banking (WWB) US$1 million capital grant from the World Bank. Ms. Tambajang is bilingual (BA French, University of Nice, France), and a leader of a 49000 member-driven Women NGO (GAWFA). She has 20 years of experience in social entrepreneurial and UNDP international development management and training. She has provided contributions to women's empowerment within a sustainable human development (SHD) paradigm. She is a GAWFA founder and board member, a former Treasurer and trainer on policy, business, and project development, as well as gender-mainstreaming. Ms. Tambajang has served in various UNDP capacities, including Chief Adviser on Policy, Program Finance, WID, and GiD, as well as capacity building of UN and national counterparts. She has ravel widely to represent UNDP Gambia and Liberia Country Offices, Gambia Government, and Women NGOs in many policy, planning, resource mobilization and meetings on gender equality and women's empowerment at all levels. She has played an instrumental role in UNDP and UN-joint country programming, program management, policy and financial advice and management, resource mobilization, and capacity and partnership building. She served as former Gambian Secretary of State for Health, Social Welfare and Women's Affairs, Policy Adviser on women and children to Presidents of the first and current republics in the capacity of chairperson of the National Women's Council, and the woman Representative to the National Economic and Social Council. Her accomplishments include the following: she initiated and facilitated the engendering of Gambia and post-war Liberia's development processes; engineered and facilitated the domestication of international human rights on women and girls (CEDAW, Beijing Platform for Action, UN Resolution 1325, And MDGs); engineered and empowered Gambian, Liberian, and other African Women to influence huge national, bi- and multilateral banks, including the World and African Banks; trained many Gambian and Liberian policy makers, planners, project implementers, and UN/ National Gender Theme Groups on socio economic gender analysis (SEGA), policy and project design, management, and monitoring and evaluation; initiated and facilitated the creation and strengthening of women's sectoral institutions, including good governance, negotiations, and agreements; engineered and facilitated the creation and strengthening of National gender focal points, the Liberian Ministry of Gender and Development Liberia-2001, UN award winning Mano River Women's Peace Network (MARWOPNET), and increased women and youth participation in good governance, business management, reporting, and peace building processes; won UNDP and national awards for outstanding contributions to the empowerment of women and youths, Country Program Success Stories. Her hobbies include reading, writing, mentoring, peace mediation, and social entrepreneurship.

Ben Botha, CEO of Socremo Bank in Mozambique

Ben Botha, CEO of Socremo Bank in Mozambique

Mr. Botha has over 30 years of experience as a Retail Banker and 10 years of experience in micro- and SME-finance. After a long career for the ABSA Group (which has over US$ 80 billion in assets) heading the Electronic Banking Division, General Manager Sales, and Managing Director of Bancura (short term insurance broking arm), Mr. Botha decided to start employing his skills to lower income markets. He has a proven record in both setting up a greenfield bank like Banco Oportunidade de Moçambique (BOM), as well as running OISL in Ghana, First Micro Finance Bank Afghanistan (FMFB-Afghanistan) and currently Socremo Bank in Mozambique.

Titos Macie, Board Chair of Socremo SA Banco de Microfinanças in Mozambique

Titos Macie, Board Chair of Socremo SA Banco de Microfinanças in Mozambique

Mr. Macie has served as the Board Chair of Socremo since 2010. Prior to Socremo, he worked at the Christian Council of Mozambique for 25 years serving in different capacities the last being the Director of Training and Organizational Development (2011-2013) and the Administrator (1998-2011). He studied at the Horizonte College and the Maputo Languages Institute.

South Sudan Microfinance Development Facility

Elijah Chol, CEO of South Sudan Microfinance Development Facility in Sudan

Elijah Chol, CEO of South Sudan Microfinance Development Facility in Sudan

Mr. Chol has served as the Managing Director for the South Sudan Microfinance Development Facility since 2013. He was previously a Microfinance Specialist at the Frankfurt School of Finance & Management (2010/2011), and a Junior consultant with the Ministry of Finance and Economic Development for three months in 2009. He also has experience as an account and worked at KPMG Kenya in 2009, all in South Sudan. Mr. Chol holds an MBA degree from Kenya Methodist University and a Bachelor of Commerce degree from Kabarak University.

Mary Akech Miller, Board Member of South Sudan Microfinance Development Facility in Sudan

Mary Akech Miller, Board Member of South Sudan Microfinance Development Facility in Sudan

Ms. Miller has served in the Ministry of Trade, Industry and Investment as the Director General since 2006. Prior to this, she worked for AAH-I in Program Management from 2003 to 2006. She also worked with the Sudan Catholic Bishop Conference as the Financial Officer from 1996 to 2002. Ms. Miller holds an MA in Management.

Ivan Mbowa, CEO of Umati Capital in Kenya

Ivan Mbowa, CEO of Umati Capital in Kenya

Mr. Mbowa worked with Citigroup for eight years across a wide variety of countries, including Uganda, South Africa, Nigeria, Ghana, and Kenya. He worked across treasury, operations, credit risk management, investment banking, and financial institutions banking. Mr. Mbowa was a business credit officer in Citigroup within the financial institutions team covering Ghana and East Africa. In his last role with Citigroup, he was part of a two-man team that launched their first wealth management consumer business in East Africa, where he was a senior investment advisor overseeing customer assets invested offshore. Mr. Mbowa helped in creating Umati Capital Limited. He holds a BA in Economics (cum laude) and a BA in International Relations (cum laude) from Tufts University, USA.

Munyutu Waigi, Board Member of Umati Capital in Kenya

Munyutu Waigi, Board Member of Umati Capital in Kenya

Mr. Waigi was born in Kenya but grew up in London. He returned to Kenya in 2009 and founded a wireless solutions provider (MoComm Wireless) in Mombasa. He later co-founded Rupu (Kenya's largest e-commerce company) & Ringier Kenya in 2010. Rupu went on to be nominated by Forbes Africa Magazine as Africa's Top 20 start-up in 2012. Mr. Waigi’s experience includes working in communication and high tech, human performance and organizational transformation, training and change management, customer experience testing, functional/process analysis, business reengineering, communications, and training. He has worked for large and diverse multinational organizations such as Ringier AG, Accenture UK, Williams Formula 1 Team, and HSBC Bank & British Telecom in different geographical locations. Mr. Waigi is a co-founder of Umati Capital Limited.

Vikas Raj, Board Member of Umati Capital in Kenya

Vikas Raj, Board Member of Umati Capital in Kenya

Mr. Raj is the Director of Investments at Venture Lab, leading the group’s work on sourcing, evaluating, and structuring investments. Prior to joining Accion, He worked in investment banking at Evercore Partners, where he advised on multiple corporate transactions with aggregate values of over $45 billion. Previously, Mr. Raj worked in microfinance, primarily in India, at Ujjivan and Catalyst Microfinance Investors (CMI). At Ujjivan, he co-led the establishment of the firm’s first lending branches in Delhi and helped lead the firm’s Series B financing round. At CMI, he was responsible for establishing and investing in the Fund’s greenfield MFIs in India, Nigeria, and the Philippines. Mr. Raj also co-led Columbia Business School’s student-run Microfinance Investment Fund. He started his career at Deloitte Consulting, where he was in the Corporate Strategy group. He has a bachelor’s degree from the University of Pennsylvania and an MBA from Columbia University.

Clive Msipha, CEO of Untu Microfinance (Private) Ltd in Zimbabwe

Clive Msipha, CEO of Untu Microfinance (Private) Ltd in Zimbabwe

Mr. Msipha is the Chief Executive Officer of the Company. He spent six years with PricewaterhouseCoopers, in the Audit and Corporate Finance departments. Subsequent to that, he worked for Actis Capital, an Emerging Markets Private Equity Firm based in London. Clive did his MBA at Oxford University prior to founding Untu in 2009.

Bartholomew Mswaka, Board Chair of Untu Microfinance (Private) Ltd in Zimbabwe

Bartholomew Mswaka, Board Chair of Untu Microfinance (Private) Ltd in Zimbabwe

Mr. Mswaka is the Managing Director of Renaissance Securities (Private) Ltd. He worked for the Reserve Bank of Zimbabwe and the Bank of Botswana before joining Edwards and Company. He left the then renamed Fleming Martin Edwards Securities where he had risen to Executive Director-Sales to join HSBC Securities as its Managing Director. Bart is a registered Stockbroker and the immediate past Chairman of the Zimbabwe Stock Exchange.

Tineyi Emmanuel Mawocha, CEO of Urwego Opportunity Bank (UOB) in Rwanda

Tineyi Emmanuel Mawocha, CEO of Urwego Opportunity Bank (UOB) in Rwanda

Mr. Mawocha joined UOB in 2014. Prior to joining UOB, he was Managing Director of Tetrad Investment Bank in Zimbabwe, where he led the transition from investment banking to a commercial banking strategy for the group, including the deployment of intelligent teller machines (ITMs), point of sale devices, and mobile banking. He also led the selection and implementation of a new core banking system and expanded their network from five to eight branches. Previously, Mr. Mawocha was CEO at Standard Bank Swaziland where he was responsible for strategic planning and bank operations at the company. He was also Director, Branch Network at Standard Bank South Africa. Earlier in his career, he worked in hospitality management in the UK and Zimbabwe, including serving as General Manager at Katete Safari Lodge. Mr. Mawocha earned a Masters in Development Finance from the University of Stellenbosch Business School and a Masters of Business Administration from the University of Zimbabwe Graduate School of Business. He also holds a Higher National Diploma in Hotel and Catering Management from Bulawayo Polytechnic.

Thamsanqa Sibiya, Board Member of Opportunity International in South Africa

Thamsanqa Sibiya, Board Member of Opportunity International in South Africa

Mr. Sibiya holds post graduates qualifications from different Universities both in the UK and South Africa and has attended and taught a number of courses at Accenture Schools of Excellence in St. Charles, Chicago, USA; Veldhoven, Netherlands; Windsor, UK and Cranfield University, UK. He has been serving as a Director of Governance at Opportunity International since 2014. In this role his responsibilities across the Owned Members of the Opportunity International Network, includes the following: identifying best practices for governance, developing guidelines, evaluating board effectiveness, participating in selected board meetings etc. board training, board alignment, and board development. In this position Thami provides a strong focus on supporting Owned Implementing Members (IM / Owned Banks) to achieve operational excellence, financial sustainability and ensuring fundraisers and donors have visibility into program performance.

As a Regional Director he serves on the boards of owned members (Opportunity owned Banks). He has the CEOs of the Owned Implementing Members (IM) reporting to him as a Regional Director and into their local boards. He is also responsible for all the boards of implementing members (IMs). Prior to joining Opportunity International, he was a joint Managing Director of R & D Screening from 2007 until 2013, a company specializing in X-Ray Equipment and is a former Chief Executive Officer of Safika Technologies Holdings. He has worked in different industries such as Utilities, Hospitality, Manufacturing, Mining, Financial Services, Telecommunications, Logistics & Transportation and Government. He has done extensive research in areas such as Neural Networks, Telecommunications, Plasma gasification, Extruders, Microfinance, as well as Gas and Energy. He has a wealth of experience working as a Management/Systems Consultant with Accenture, an internationally renowned Consulting firm. He serves on a number of boards within Opportunity Network such as Opportunity International, Banco de Oportunidade Mocambique, Urwego Opportunity Bank, Rwanda, Opportunity Tanzania, Opportunity Kenya, Opportunity DRC, Octagon Marketing, R & D Screening, Bhambatha Business Service, etc. as a non-executive director or as an independent director in different industries. He has previously held senior positions in civic organizations on a part-time basis.