Uma (left) with her niece. Uma lives with her brother's family. Her niece helps by taking Uma to MFI group meetings, while pursuing a university degree.By Misha Dave, Program Associate/Manager, Financial Inclusion for Persons with Disabilities, Center of Financial Inclusion at Accion Technical Advisors India.

Uma (left) with her niece. Uma lives with her brother's family. Her niece helps by taking Uma to MFI group meetings, while pursuing a university degree.By Misha Dave, Program Associate/Manager, Financial Inclusion for Persons with Disabilities, Center of Financial Inclusion at Accion Technical Advisors India.

Click here for more stories on disability inclusion from India.

Uma lives in the Old Pension Mahula neighborhood in Bangalore with her brother, a rickshaw driver, and his family. She is the third oldest in a family of six sisters and one brother. As I navigate a busy bustling commercial street, enter an alley dotted with clothes hanging to dry, and climb a steep and narrow set of stairs to Uma’s home, I wonder how a person with a disability manages to get in and out of this home? I am warmly welcomed with a chilled steel tumbler of Fanta. As I talk with her in her small apartment, sitting on a chittai, the photos of her deceased parents, originally from the Rajput community in Tamil Nadu, proudly hang above her. She is surrounded by a beaming niece, full of optimism about the family’s future, and a supportive sister who has been crucial in her journey as a new entrepreneur with a disability.

Uma was only 15 years old, a young girl completing her 10th grade studies, when she started to feel intense and frequent joint (bone) pains in her arms and legs. As a result, she was admitted to a hospital for surgery to insert four metal rings in her leg. Something went wrong during her leg operation and consequently she lost complete function in both legs and was no longer able to walk. Doctors took no responsibility for what happened to her on the operating table and how it rendered her immobile for life.

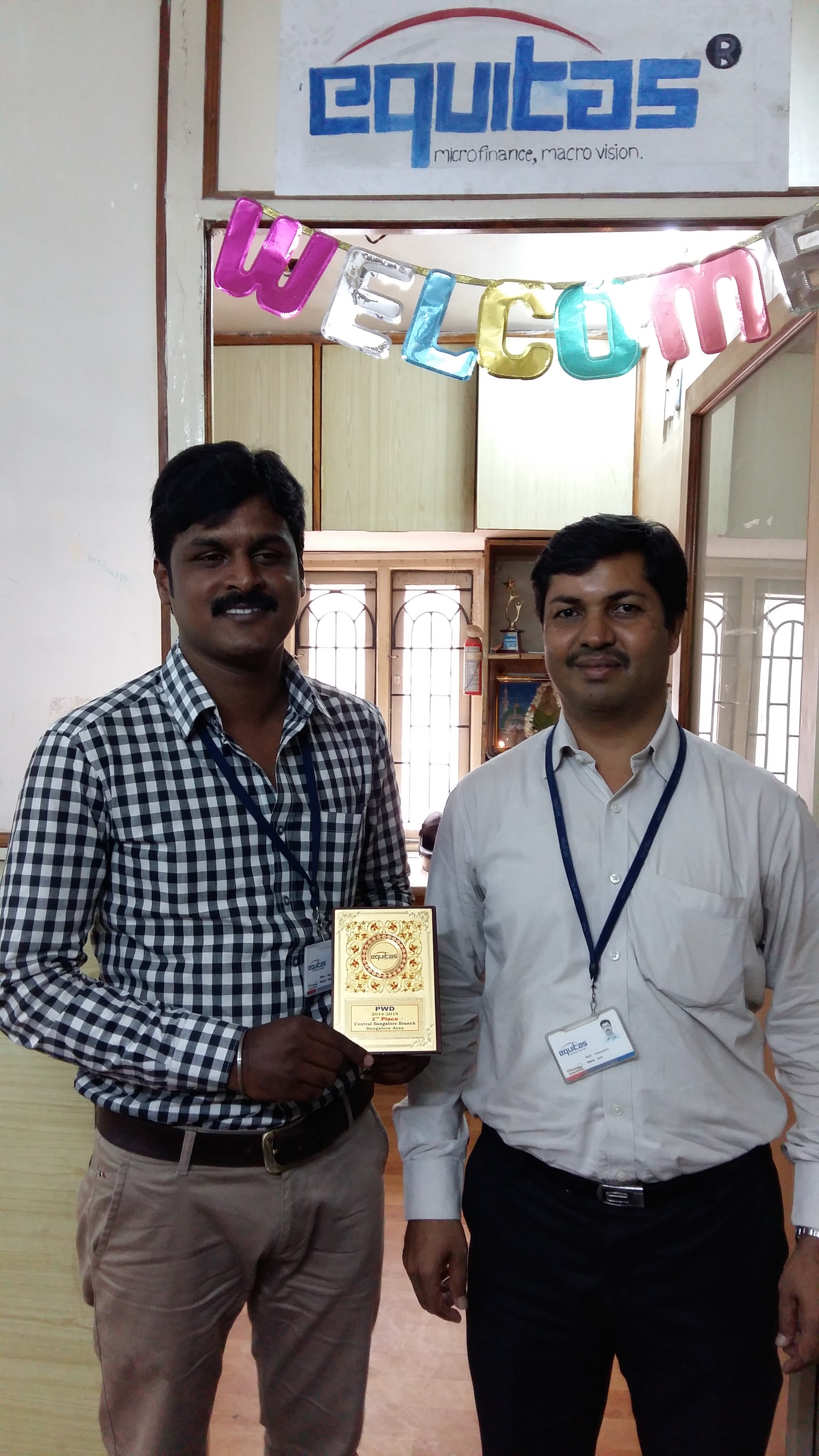

For 25 years Uma has been immobile and confined to her brother’s apartment which has steep narrow stairs. She is grateful for a supportive family and a brother who has taken care of her financially all these years, but he is a daily-wage earner himself, struggling to make ends meet. Uma has never married to have a family of her own – a common reality for disabled women in India. In India, where wealth is often passed down through marriage, women with disabilities are mostly excluded from this social institution, and therefore are at a further economic disadvantage. The branch manager and a loan officer from an Equitas branch office that won an award for their disability-inclusion work.Two years ago, she decided she wanted to work to contribute to the family income, to be productive, to feel better about her situation and have a more meaningful life. Her options were limited, but thanks to her sister, and a lady in the neighbourhood who sells flower garlands for religious ceremonies and weddings, she was able to start a business stringing flowers into garlands from her home. Uma gives this lady money to buy flowers from the wholesale market, and then gives her finished products to sell on the street.

The branch manager and a loan officer from an Equitas branch office that won an award for their disability-inclusion work.Two years ago, she decided she wanted to work to contribute to the family income, to be productive, to feel better about her situation and have a more meaningful life. Her options were limited, but thanks to her sister, and a lady in the neighbourhood who sells flower garlands for religious ceremonies and weddings, she was able to start a business stringing flowers into garlands from her home. Uma gives this lady money to buy flowers from the wholesale market, and then gives her finished products to sell on the street.

One day, a neighborhood acquaintance approached Uma and suggested she take advantage of business loans from Equitas Microfinance, as she had heard they were helping the disabled. She was receiving a group loan from Equitas herself and was advised of their disability-inclusive policies. The next day, Uma’s niece carried her down to the street and took her by rickshaw to meet with Equitas officials at their Bangalore branch office in Shanti Nagar. Since then Uma has been part of the Equitas group loan program, and is a member of a group of 14 women entrepreneurs in her community. To accommodate Uma’s disability, Equitas has permitted her sister to attend meetings and make the repayments on Uma’s behalf to avoid a difficult commute, as most buildings and forms of transport in India are not accessible. Equitas Microfinance has received disability awareness and sensitization training through CFI’s Financial Inclusion for Persons with Disabilities program. As a result, their field staff and branches are equipped and sensitized to include disabled clients in their mainstream financial products and services. The Bangalore branch in particular has received an internal award for their disability inclusive practices.

Uma is a first time loan recipient and has received a loan of 13,000 Indian Rupees (US $206) to be repaid in 27 installments. She is using this loan to buy more flowers and materials to make around 2 kg of flower garlands a day. Prior to the loan, Uma was making a profit of 500 Rs (US $8) per month and now with the loan she is able to expand her business, double sales, and make a profit of 1000 Rs (US $16 per month. Her niece also proudly admitted she is using part of the loan to help her pay for her college tuitions. Uma's story is an example of a family that is working together to achieve upward mobility, in part thanks to financial inclusion.