Researched by: Stephen Thomas, Director of Risk Management at Credit Suisse

Introduction

The microfinance industry in Morocco enjoyed many years of strong growth in a relatively lightly regulated environment, and then it experienced a period of crisis during which loan default rates rose to worrisome levels and the financial soundness of a number of microfinance institutions (MFI’s) became imperiled. The regulatory authorities realized that microfinance lending, as it was being practiced, was too often harming the very people that it was intended to help. In response, the authorities with the support of the government have embarked on a well-targeted and ongoing campaign to restructure and regulate the industry in a way that will allow it to achieve sustainable positive growth over the long term. At the heart of this initiative are policies designed to promote client protection. Tangible progress has been realized in the past three years:

- The legal framework has been updated and enhanced to allow for more effective regulation and oversight of the industry.

- The MFI’s have improved their lending practices and strengthened their finances.

- Measures have been put in place to advance the adherence to the principles of client protection.

While much has been achieved to date, there remains much more yet to be accomplished.

Background

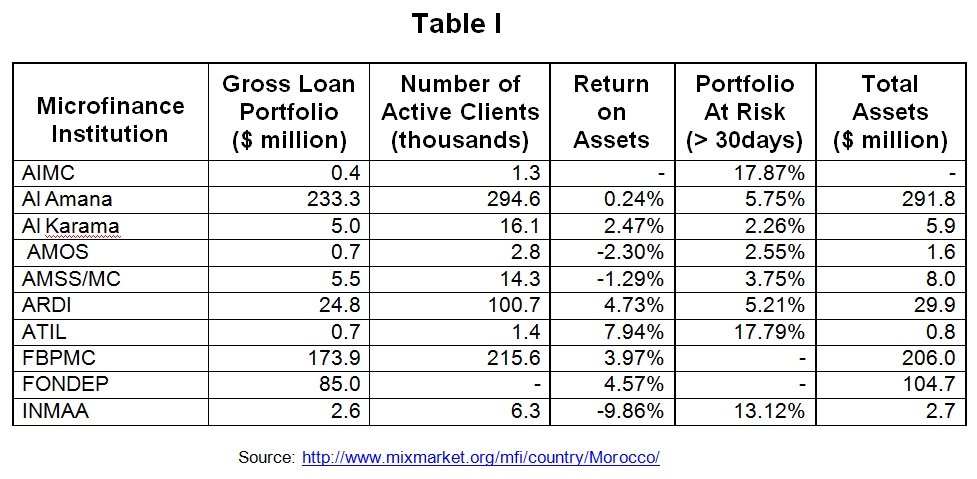

Morocco has one of the most extensive and vibrant microfinance sectors in the MENA region; the other being in Egypt. Currently the Moroccan microfinance industry counts some 800,000 clients and the value of the outstanding loans is in the order of $460 million, according to 2011 statistics. There are 10 active MFI’s, listed in Table 1, of which the three largest, Al Amana, FONDEP and FBPMC, control over 80% of the market in terms of loan portfolio value. The activity is distributed throughout the country with the clientele being roughly 60% urban and 40% rural.

The MFI’s in Morocco were given a legal framework within which to operate through the Law No. 18-97, enacted in 1999. The sector experienced rapid and significant growth up to 2006 when problems began to surface. The rate of nonperforming loans, which had been very low historically, began rising noticeably over an extended period of time. This prompted the Central Bank of Morocco, the Bank Al-Maghrib (www.bkam.ma), to intervene into what had been up to that point a lightly regulated industry. The Bank’s initiatives included on-site inspections of the loan portfolios of the various lending agencies, the MFI’s. The principal finding was the existence of a significantly high level of cross-borrowings – approximately 40% of the borrowers had multiple accounts, i.e., outstanding loans with two or more MFI’s. There were no controls in place to prohibit or even limit such cross-borrowings with the results being that a growing number of borrowers had become over-indebted relative to their ability to repay their loans.

Over the next 3 years, the growth of the sector came to a halt, and the financial performance of the existing loan portfolios deteriorated. For example, by 2008 the level of loans at risk, i.e., greater than 30 days past due, had reached 5% as compared to the level of 0.5% in 2004. Nonetheless, over this period of time, and continuing to the present, the government has enacted a number of laws designed to improve the regulation of the sector. At the same time, the Central Bank has taken a series of steps to effectively enforce these laws and to expand its oversight of the lending activities in the market. As a result of these efforts, the financial performance of the microfinance sector has greatly improved in recent years as the percentage of loans at risk has diminished from a high of 6.4% in 2009 to 4.3% in 2011 and the industry has returned to profitability. In addition, the implementation of industry-wide credit qualification and risk management procedures has virtually eliminated instances of clients’ engaging in cross-borrowing beyond their ability to service their debts. The industry is once again experiencing growth at a sustainable rate. The principles of client protection have been incorporated into the operating policies of the market participants, and a culture of client protection is being effectively instilled within the industry.

Legal Framework

The Central Bank is the entity that is primarily responsible for regulating and supervising the microfinance industry throughout the country. Within the Bank, the ‘Office of Bank Supervision’, inside of the ‘Department of Oversight of Financial Institutions’, is the division that has direct supervisory responsibility. The Bank’s regulatory authority was initially formalized through Law No. 34-03, enacted in 2006. Specifically, Articles 105-120 define the regulatory authority of the Central Bank. Since then, it has been expanded and reinforced through a series of subsequent laws and regulatory orders.

The microfinance industry experienced very strong growth during the period 2005-07. By 2008, however, the Central Bank observed that the rate of nonperforming loans had been rising for some time and that the level of loans in default had reached a historically high rate of 5%. The Bank responded by tightening its regulation of the industry through legislation bolstered by on-site inspection and, when necessary, intervention. The most noteworthy of its actions was its role in facilitating the merger of the Fondation Zakoura with the Banque Populaire pour le Micro-Crédit (FBPMC) in May 2009. Zakoura was one of the two dominant MFI’s in Morocco and had experienced rapid growth in the years preceding 2009 but without effective risk management controls. By the fall of 2008, its portfolio at risk (> 30 days) had reached an excessively high level of 11.6% and its financial instability had become a threat to the entire microfinance sector. The Central Bank arranged the merger in order to avoid a crisis. Once this emergency action was completed, the Government and the Central Bank began the process of restructuring the regulatory environment of the industry in order to create a more sustainable model.

The new regulatory requirements were issued through the ‘Directive on the Governance of Microfinance Associations’, enacted in September 2009. This law provides further clarification of the managerial obligations with regard to governance, internal controls, external audit, the management of credit, liquidity and operational risks, and transparency in the dissemination of information concerning each institution and its operating performance. The Central Bank instituted formalized reporting policies to which the MFI’s must comply. Furthermore, it has required the MFI’s to implement risk management policies and procedures to improve the management of their loan portfolios. Since 2006, the Central Bank has had in place a practice of making regular on-site visits to the various MFI’s for the purpose of observing the operating practices, evaluating governance and internal controls, assessing the quality of the loan portfolios and verifying the conformance to the regulatory framework. This has been strengthened and the Bank stands prepared to intervene in the operations of an MFI when deemed necessary. Such intervention may take the form of:

- Dictating improvements in operating procedures

- Requiring the write-off of impaired loans

- Implementing transparency practices

- Adhering to client protection guidelines

The Bank also makes it clear that a failure to comply with its directives may result in the suspension of operations or the revocation of the banking license.

Also in 2009, regulations were enacted requiring the MFI’s to classify all loans and declare the level of non-performing loans in their respective portfolios. Furthermore, they were thereafter required to maintain reserves sufficient to cover the potential loss exposures.

Risk management practices have likewise been significantly enhanced. For example, the MFI’s are required to implement a formal process to verify, i.e., fact check, the information submitted in each loan application. A key element in the realization of an effective nation-wide risk management policy has been the creation, in 2009, of the ‘Centralized Risk Repository’, "La Centrale des Risques", by the Central Bank. This Risk Repository fulfills the role of a credit bureau. The MFI’s are obligated to submit to the Repository the relevant information on all existing and prospective clients. Consulting the facility before approving new loans has allowed the MFI’s to significantly improve their management of credit risk. The Repository has also given the Central Bank the ability to monitor and manage the risks within the microfinance industry at all levels, e.g., cross-borrowings, over-indebtedness, loans in arrears, etc.

For policy-makers, protecting the microfinance industry from credit abuses and maintaining its financial stability are critical elements to assuring the protection of clients. One of the tools employed to prevent the proliferation of cross-borrowings and to improve credit quality has been the sharing of client and loan information among the MFI’s. This has proved to be an effective policy in resolving the problem; however, it does raise the question as to the protection of confidential client information. To address this concern, the government enacted Law No. 09-08 which provides a series of legal protections of confidential and personal information in all matters financial and otherwise. The MFI’s have formally incorporated this concept into their business practices. Nonetheless, the effective protection of client privacy will require ongoing oversight on the part of the Central Bank.

Another major area of interest in the effort to improve client protection has been the initiative to provide true transparency in loan pricing. Originally, the law gave the Central Bank the authority to impose an interest rate cap on microfinance loans; however, no such cap was ever enacted as it has never been deemed to be necessary. On the other hand, there have never been restrictions on fees and other costs that could be imposed within the terms of the loan contract; nor were there any requirements regarding the declaration or explanation of such terms. As a result, the market developed complex pricing strategies that very often left the client unaware, or confused about the total cost of the loan. Now, however, the regulations require that certain standards of transparency be met with regard to the terms of each and every contract. The contractual obligations must be clearly stated and understandable to the client. The principle of transparency, as it is being enforced by the Central Bank, covers the full disclosure of all costs involved in the lending relationship and the requirement that the loan documentation be complete and understandable to the client. The Bank’s concern is that borrowers have a thorough understanding of the full costs of their respective loans and that the MFI’s maintain a high standard of service by adhering to the principles of client protection and by dealing in good faith.

The principles of client protection have been formally defined in the ‘Microfinance Code of Ethics’, adopted in 2010. The Code incorporates the concepts that are enumerated in the Smart Campaign’s ‘Client Protection Principles’. The Central Bank was instrumental in motivating the industry as a whole to collaborate on the creation and implementation of the Code. Although it does not have the force of law, it is intended to serve primarily to induce the MFI’s to incorporate the concept of client protection into their business philosophy. Significant progress has been made in this regard as the MFI’s have adapted their business practices to conform to the stated principles.

The Code also includes a clause that obliges the parties of any non-criminal dispute to seek resolution through arbitration. To facilitate this dispute resolution, the government has created a network of local tribunes called "tribunaux de proximité" whose mission is to provide rapid resolution of complaints while applying the precepts of the Code of Ethics and respecting the dignity of the plaintiffs. These tribunes are proving to be more efficient than the traditional court system, and their success is furthering the cause of client protection.

Microfinance Institutions

There are twelve active MFI’s in Morocco. The ten that report to Mix Market are listed in Table

I. The remaining two are Tawana and Microcrédit du Nord

Networks

The principal Moroccan microfinance network is the Fédération Nationale des Associations de Microcrédit, FNAM, (www.fnam.ma). Its membership includes all twelve Moroccan MFI’s. FNAM has played a leading role in enlisting all of the MFI’s to incorporate the Code of Ethics into their operating practices and to make significant progress toward providing transparency in their lending procedures and product pricing.

Sanabel is also active throughout the MENA region and has an ongoing campaign to improve the performance of the microfinance industry and, in particular, to promote adoption and implementation of the Client Protection Principles.

Conclusion

Morocco has achieved significant progress in stabilizing the microfinance industry and in implementing regulations that will promote client protection. The cooperation among the regulatory authorities, the IMF’s and the NGO’s active in the country has created an environment favorable to the future development of the industry. Yet much remains to be done. One important initiative on the horizon concerns a regulatory initiative to standardize the interest rate practices across the industry and to establish specific requirements to be met in terms of business transparency with respect to the clients.

Back to Client Protection Library