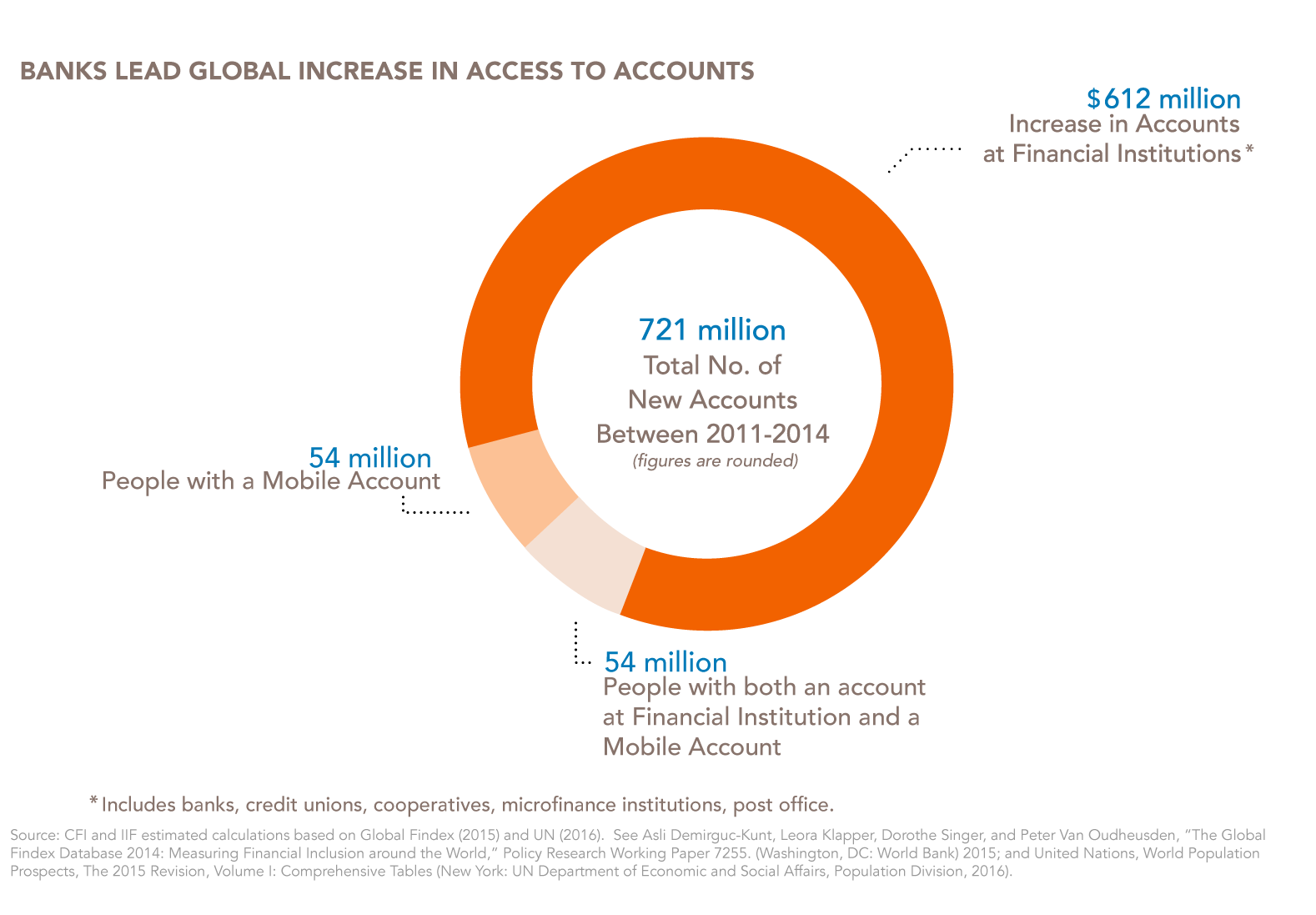

This study – produced in partnership with the Institute of International Finance - examines the underreported role of banks in driving financial inclusion. Of the 3.2 billion people in the world with financial transaction accounts, 97 percent hold an account at a financial institution. According to the World Bank’s Global Findex database, over 90 percent of the 721 million new accounts opened between 2011 and 2014 were opened at financial institutions—the vast majority banks, but also including credit unions, cooperatives, microfinance institutions, and postal banks. Banks are playing a leading role in providing and extending financial services to underserved populations. Thanks to advances in technology, banks are also increasingly designing viable business models to serve unbanked and underbanked populations, which Accenture has estimated as a $380 billion market opportunity.

To better understand the strategies enabling this growth, and to help banks, their partners, and the public sector work together to reach the next 2 billion, the Institute of International Finance (IIF) and the Center for Financial Inclusion (CFI) interviewed executives from 24 leading banks working in emerging markets to understand their business strategies, how technology and partnerships can enable inclusion, and where they see obstacles going forward.

Banks’ Top Opportunities in Financial Inclusion

1. Build on digital payments, including:

a. G2P - procurement, payroll, social transfers, pensions, etc.

b. Private sector - retailers, consumer goods companies, payroll, etc.

2. Start with the underbanked and use data to understand their needs.

3. Cross-sell the full range of products.

4. Address the usage gap by building financial capability.

5. Develop the ecosystem through bank-led partnerships, increasing customer convenience while sharing costs and risk.

6. Enable remote account opening using digital IDs, supported by proportional, tiered KYC requirements.

7. Align all systems to digital banking, benefiting banked, underbanked and unbanked customers.

Banks’ Top Barriers to Financial Inclusion

1. Lack of trust - in banks, in digital, in agents - leading to lack of uptake.

2. Lack of financial capability and digital literacy - leading to lack of usage.

3. Agent networks - building them, equipping them, ensuring their quality.

4. Data - privacy, security, cost, lack of capacity to analyze the data, lack of willingness for parties to share data, and regulations around these issues.

5. Regulatory issues, especially pricing, capacity, and KYC requirements.

6. Lack of coordination among government bodies.

7. Lack of connectivity/infrastructure.

Download the Publication here »

Download the Executive Summary here »

Download the Fact Sheet here »